Understanding CSCRF Compliance: How TM Solutech Empowers SEBI-Regulated Entities

Introduction: Why CSCRF Matters?

With the growing adoption of technology in India’s financial sector, SEBI-regulated entities (REs) are facing an increasing number of cyber threats. To address these risks, the Securities and Exchange Board of India (SEBI) has introduced the Cybersecurity and Cyber Resilience Framework (CSCRF), a comprehensive set of guidelines to strengthen cyber defenses and ensure business continuity.

The deadline for compliance is March 31, 2025, making it imperative for SEBI-registered entities—including stock exchanges, brokers, depositories, mutual funds, and investment advisors—to take immediate action. The framework outlines governance measures, operational controls, and cyber resilience strategies that help organizations anticipate, withstand, contain, recover, and evolve from cyber incidents.

Key Requirements of CSCRF

To ensure a strong cybersecurity posture, SEBI’s CSCRF mandates organizations to implement a structured approach covering:

- Governance & Risk Management: Defining cybersecurity policies, roles, and responsibilities.

- Access Control & Authentication: Implementing multi-factor authentication (MFA) and strong password policies.

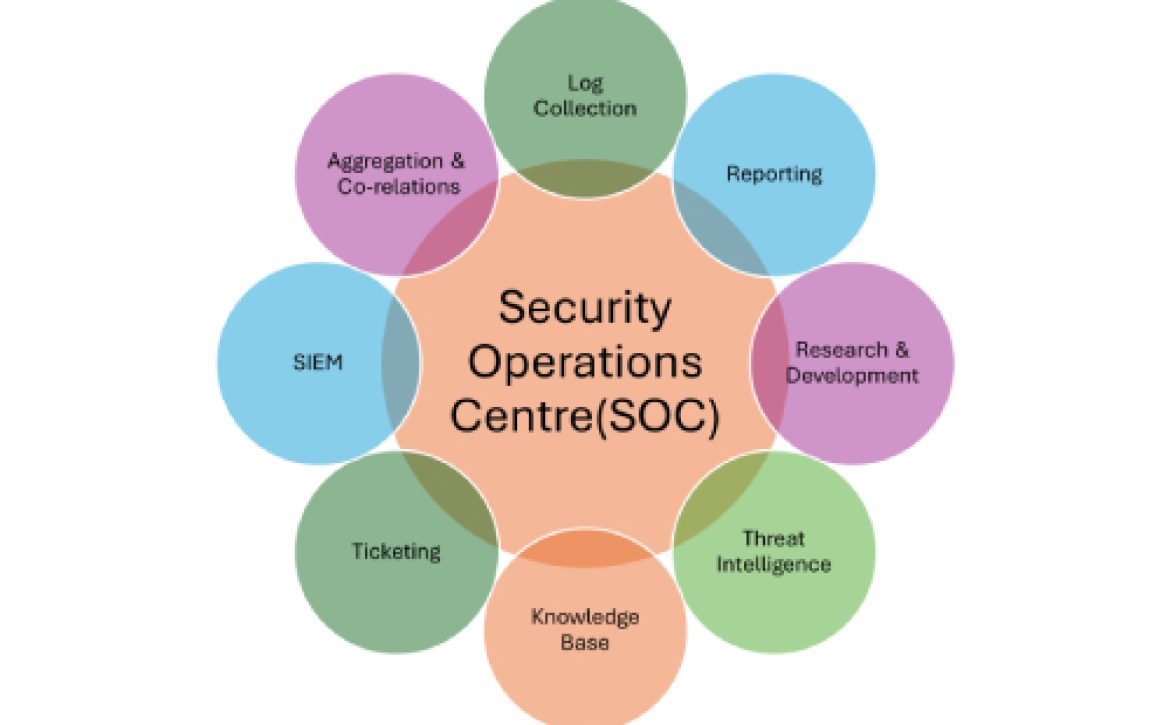

- Continuous Monitoring & Threat Detection: Establishing a Cyber Security Operations Center (C-SOC) for real-time threat analysis.

- Incident Management & Reporting: Strengthening the process for detecting, analyzing, and reporting security incidents to SEBI.

- Network Security: Deploying Next-Generation Firewalls (NGFWs), secure VPN access, and LAN segmentation for secure connectivity.

- Data Protection & Encryption: Implementing Data Loss Prevention (DLP), email security (SPF, DKIM, DMARC), and encryption for data in transit.

- Regular VAPT & Patch Management: Conducting Vulnerability Assessments & Penetration Testing (VAPT) at defined intervals.

- Cyber Crisis Management Plan (CCMP): Aligning business continuity and disaster recovery plans with SEBI’s cyber resilience guidelines.

These measures ensure that financial institutions mitigate cyber risks while maintaining operational resilience, protecting sensitive customer data, and complying with SEBI’s regulations.

How TM Solutech Helps SEBI-Registered Entities Achieve CSCRF Compliance

At TM Solutech, we provide end-to-end cybersecurity solutions tailored to meet CSCRF requirements for SEBI-regulated entities. Our approach ensures seamless compliance, risk mitigation, and operational efficiency.

Unified Cybersecurity Framework for CSCRF Compliance

We offer a comprehensive cybersecurity framework that integrates all key security controls, including:

- Business IT Asset Management: Tracking and securing all critical IT assets.

- User Access Control & Authentication: Implementing MFA, restricted admin usage, and privileged access management.

- Secure Email & Messaging Systems: Enforcing anti-phishing, anti-malware, and email security policies.

Advanced Threat Management & Security Operations

We help organizations proactively monitor, detect, and respond to cyber threats with:

- Security Information & Event Management (SIEM): Centralized log analysis and real-time threat intelligence.

- Managed SOC Services: 24/7 security monitoring to detect suspicious activities.

- Incident Response & Forensics: Quick response to security breaches and forensic analysis.

Network & Endpoint Security Enhancement

We ensure financial institutions maintain secure and segmented networks, preventing unauthorized access and data breaches through:

- Next-Gen Firewalls & Web Application Firewalls (WAFs) for securing API & trading platforms.

- Endpoint Protection: Blocking unauthorized software, managing configurations, and implementing strict access controls.

- VPN Security: Enforcing encrypted remote access for financial operations.

Data Protection & Leakage Prevention

To comply with CSCRF, we provide robust data security solutions:

- Data Loss Prevention (DLP): Preventing unauthorized data exfiltration.

- Backup & Encryption Strategies: Secure backup solutions with encrypted storage.

- Mobile Device Management (MDM): Securing corporate email, CRM, and financial applications.

VAPT, Patch Management & Compliance Audits

We ensure continuous security testing and compliance monitoring with:

- Regular Vulnerability Assessments (VA) & Penetration Testing (PT).

- Automated Patch Management for immediate risk remediation.

- Audit Logs & Compliance Reporting for SEBI-mandated cybersecurity assessments.

Cybersecurity Awareness & Training

A crucial aspect of CSCRF compliance is employee awareness. We conduct:

- Security awareness programs for employees, customers, and stakeholders.

- Simulated phishing exercises to train employees on recognizing cyber threats.

- Workshops on regulatory compliance to align IT teams with SEBI’s cybersecurity requirements.

Conclusion: Ensure CSCRF Compliance with TM Solutech

Meeting SEBI’s CSCRF compliance requirements is not just about regulatory adherence—it’s about safeguarding your financial institution from ever-evolving cyber threats. At TM Solutech, we help SEBI-registered entities achieve end-to-end cybersecurity compliance with our proactive security solutions, managed services, and compliance-driven approach.

📌 Don’t wait until the last minute! Ensure CSCRF compliance before the March 31, 2025 deadline with TM Solutech. Contact us today to schedule a free consultation and secure your financial infrastructure.

📞 Call us at: +91 79 47717070

📧 Email: info@tmsolutech.com